The company has used the money to pay for the payroll and other eligible expenses. Account Debit Credit Cash 100,000 Loan Liability 100,000

The journal entry is debiting cash of $ 100,000 and credit loan liability of $ 100,000. The company ABC has received a loan from the bank of $ 100,000.

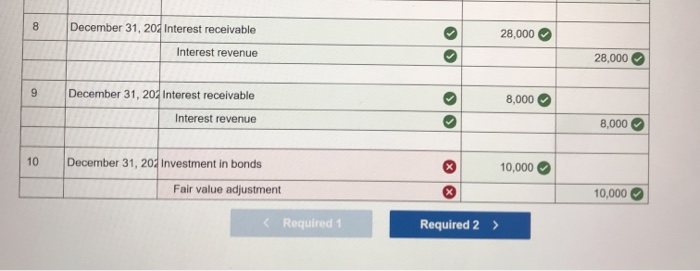

Please prepare the journal entry for PPP loan forgiveness. The compnay has decided to apply for the PPP loan forgiveness and get approval. Account Debit Credit Loan Liability $$$ Other income – PPP loan forgiveness $$$ ExampleĬompany ABC is a small business, they have a loan from the bank of $ 100,000 to support the operation during the pandemic. If they get approved, they have to revere the loan and record income. Account Debit Credit Cash $$$ Loan Liability $$$Īfter that, the company requested loan forgiveness. When the company borrows money to support the operation, they record debiting cash and credit loan liability. In other words, the business should record it as income after getting loan forgiveness. It means the grant is to support the business expense, so it should be recorded in the same period as the expense. In the PPP loan forgiveness, the government provides grants to business to pay for the payroll and other eligible expenses. If the grant is provided to reimburse the expense, the company has to record the income in the same period to cost recognition. If the grant is provided in form of fixed assets, the company has to record income in accordance with the assets depreciation expense. It is similar to the government grant under IAS 20. So there is no proper accounting standard to reflect the PPP loan forgiveness.īased on the fact of loan forgiveness, the government provides loans to support eligible small businesses which allow them to keep paying their employee and run their operation. The payroll and other compensation is remaining the same.įor the up to date reference please check this link: Journal Entry for PPP Loan forgivenessĬurrenty, there is no specific US GAAP that provide clear guidance for the for-profit entity that receives grant besides tax credit or revenue from a contract with the customer.The total loans are spent on payroll and other eligible expense.At least 60% of the loan is spent on the payroll.To be eligible for the PPP loan forgiveness, the company must comply with the following condition:

The US government approve the fund amount of $ 953 billion through this program to ensure these businesses continue to operate and pay their employees. Paycheck Protection Program (PPP) is the fund approved by the US government that aim to help small business, sole entrepreneurs, and self-employ who suffer from the impact of the pandemic. SBA is the US government agency that provides support to small businesses and entrepreneurs. Loan forgiveness (or PPP = Paycheck Protection Program) is the program that prepares by the SBA (Small Business Associate) to support the small business. In short, the bank or creditor cancels the loan that issues to the customer. Loan forgiveness is the process by which the creditor stops demanding the company pay back the loan.

0 kommentar(er)

0 kommentar(er)